Fraud Risk

Our fraud risk SaaS platform delivers dashboards, real-time risk signals, and APIs for compliance, risk, investigative, and insurance teams to run proactive KYC, AML, underwriting, and third-party risk assessments.

Powered by 30+ years of curated news and an EU-wide knowledge graph spanning companies, directors, and locations, we uncover hidden fraud risk signals and deliver predictive fraud risk severity at scale.

Detect and Prevent Fraud

Proactive Fraud Detection

Detect emerging fraud risks early through continuous monitoring and intelligent notifications across your counterparty ecosystem.

Comprehensive Risk Insights

From unstructured media to structured corporate data, we leverage AI to surface fraud-related notifications and assess severity before it impacts your business.

Fraud Risk Network Graph

Interactive network graphs reveal hidden relationships across corporate groups, shareholders, and directors – revealing indirect fraud exposure arising from complex ownership and control structures.

"The advantage of knowing about risks is that we can change our behavior to avoid them."

You can assess any company, director or location for fraud risk, whether through direct exposure or through its network of linked companies, directors, and locations. We also proactively alert you whenever there is a change in a company’s fraud risk profile.

Our insights are primarily driven by large-scale news scanning, combined with network analysis that maps connections to exposed companies. All fraud-related signals are consolidated into a single, structured fraud risk report for every company in Belgium.

Each report brings together fraud risk indicators, adverse media coverage, court judgments, network relationships, and financial data to deliver a clear, evidence-based assessment of fraud risk.

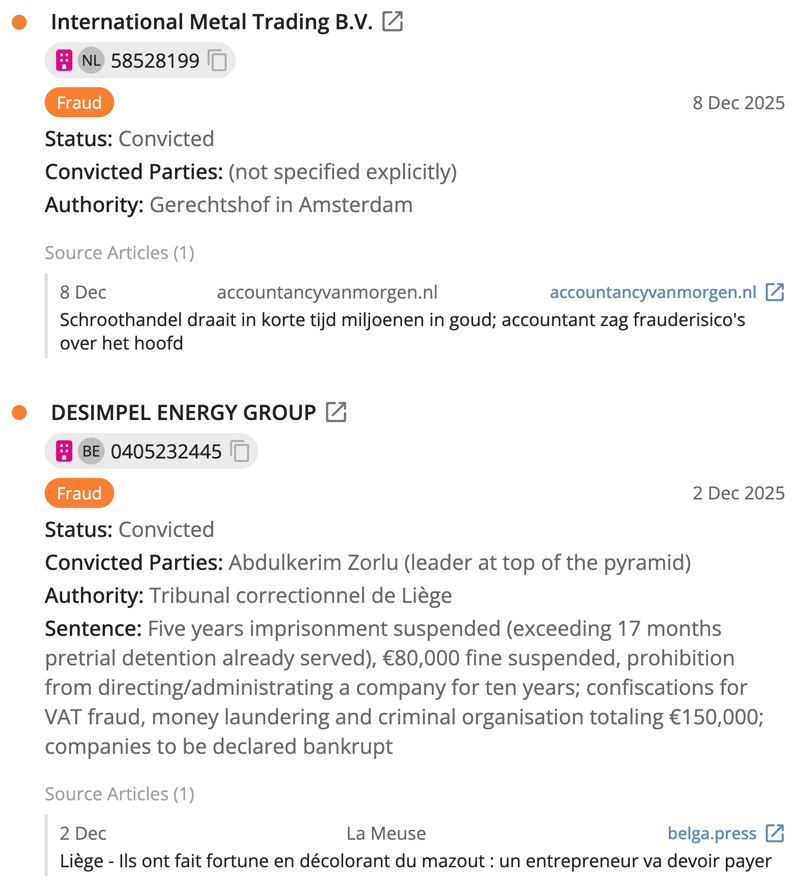

Fraud Risk Events Alerts

Fraud Risk Event Alerts combine AI-driven media monitoring with expert validation to surface material developments that impact fraud risk severity.

We identify fraud events linked to companies and individuals, providing insight into proven or alleged misconduct. In parallel, we extract court cases and financial penalties to capture legal and regulatory actions that act as predictive signals of elevated fraud risk. Together, these verified events deliver timely, structured visibility into both historical fraud exposure and emerging fraud risk drivers.

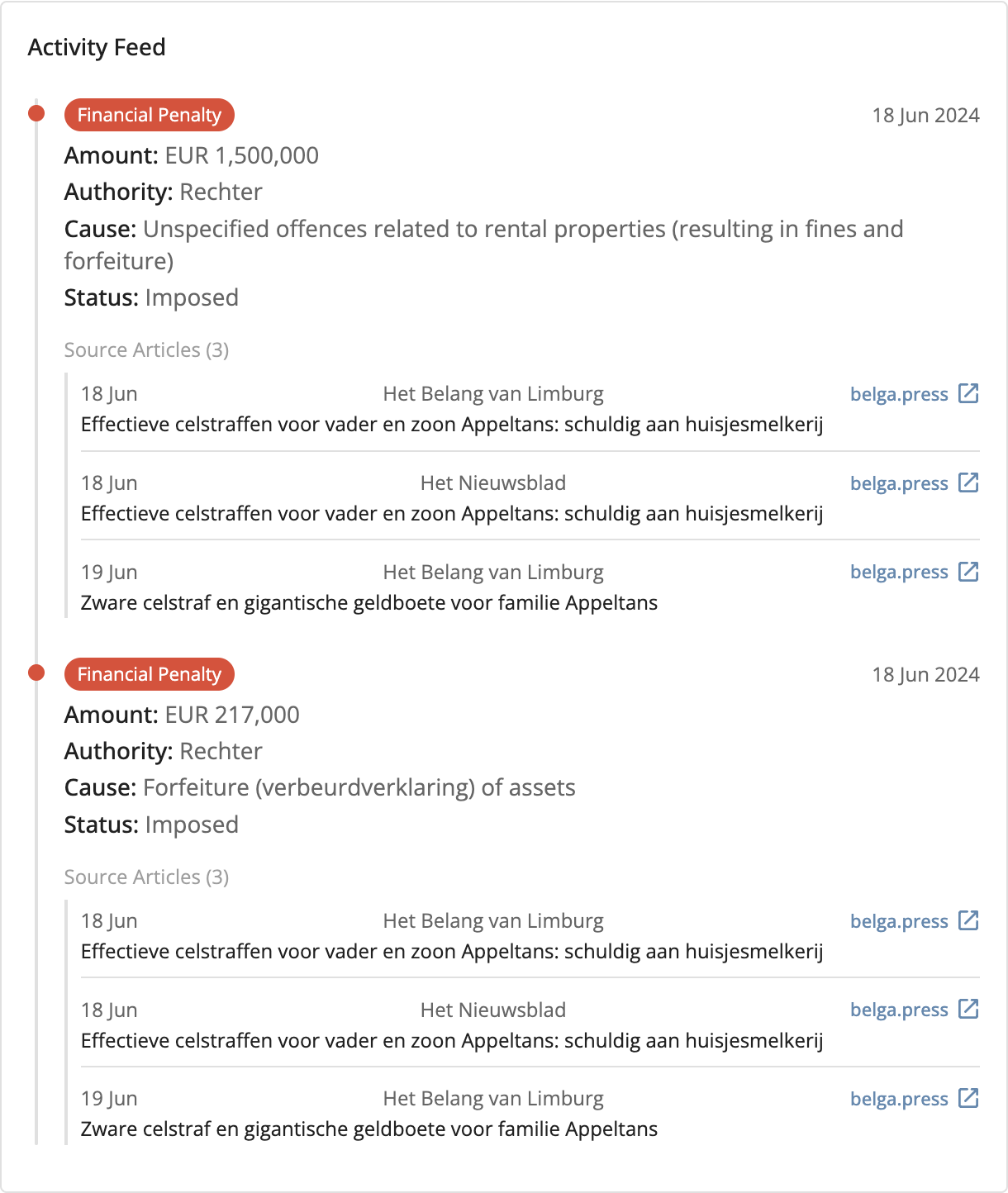

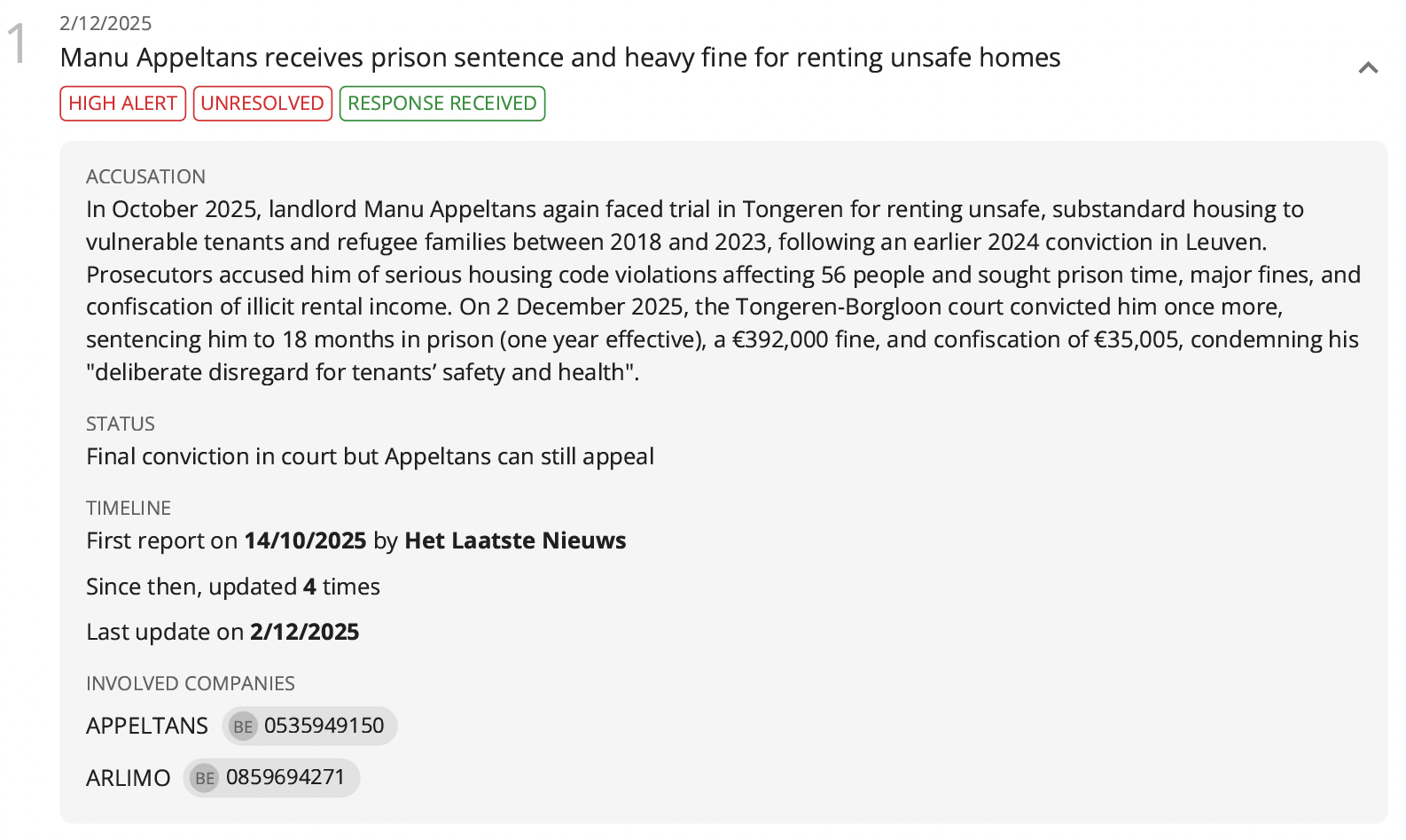

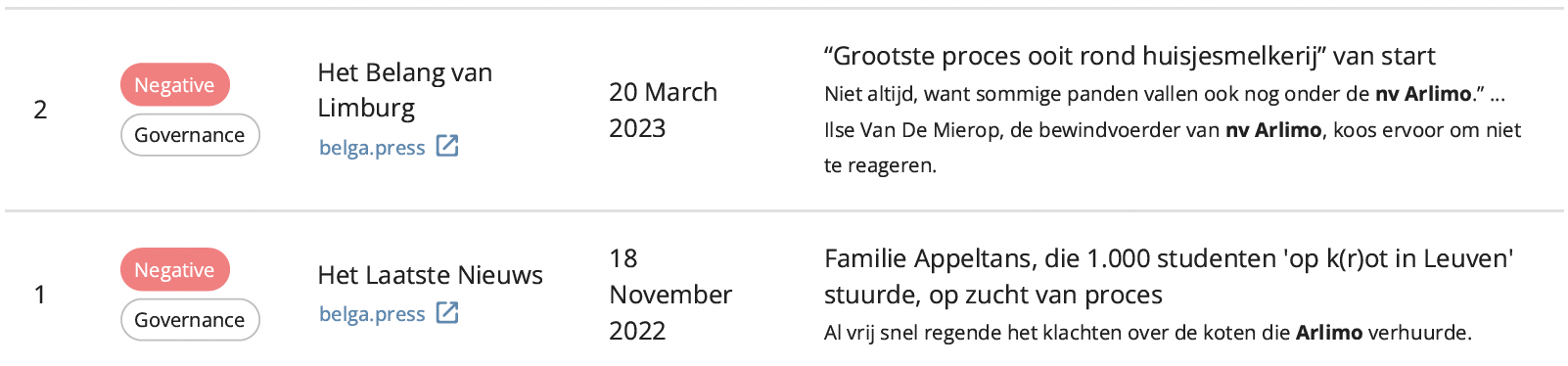

Business Conduct Risk Cases

Business conduct risk cases capture legal, ethical, and governance issues that materially increase fraud risk severity.

Independent experts verify and structure each case, providing a clear summary, involved entities, a timeline of relevant news articles, and defined severity and status indicators. Where no public response exists, the company’s position is actively sought and documented, while unresolved conduct risks continue to be reflected in fraud risk severity.

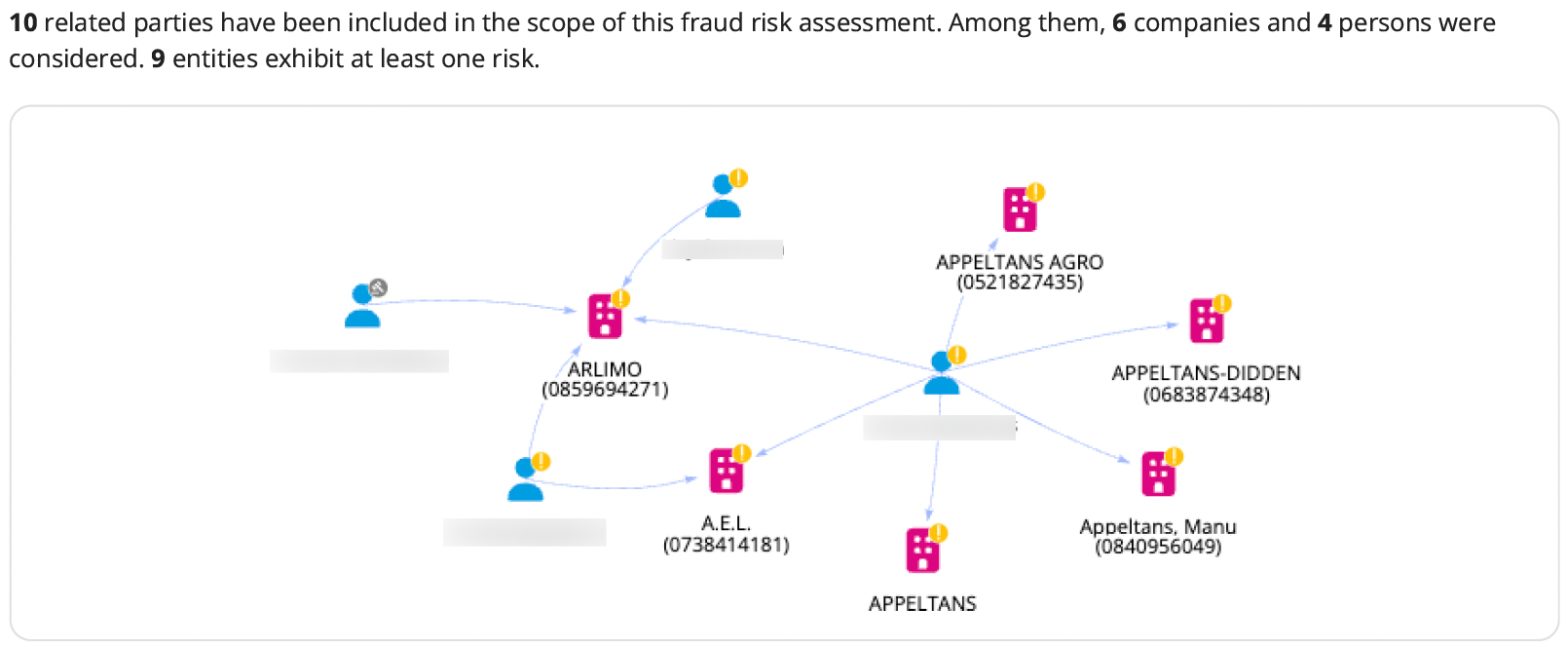

Fraud Risk Network Graph

Visualize complex ownership and control structures through interactive network graphs that expose hidden relationships across entities and individuals.

Clear risk flags highlight companies and persons linked to fraud risk notifications, helping teams quickly prioritize investigations and understand indirect exposure.

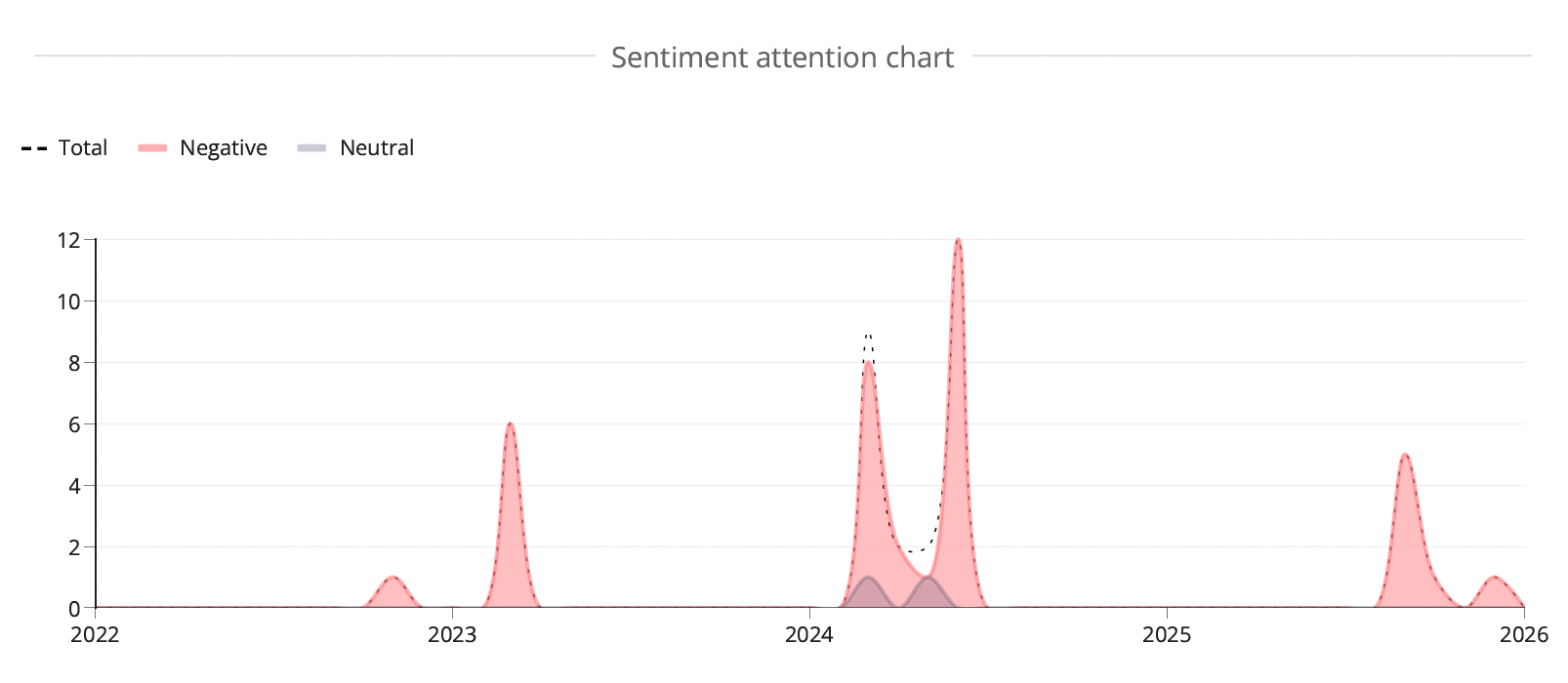

Adverse Media Snapshot (Governance filtered)

We provide a governance-filtered adverse media snapshot that highlights only the most relevant news impacting governance risk.

The sentiment attention chart offers an immediate view of how sentiment around governance-related topics evolves over time, helping you to quickly identify emerging issues or periods of heightened attention.

You can drill down into individual articles to understand the underlying events and gain deeper insight into governance risks affecting the company.

Want to spot fraud risk before it affects your business?

Contact us to see how our fraud risk indicators, informed by adverse news, support proactive monitoring.